This case study is protected under an NDA. All company names have been replaced with fictional ones. For more information about this project, please contact godhani25shreya@gmail.com

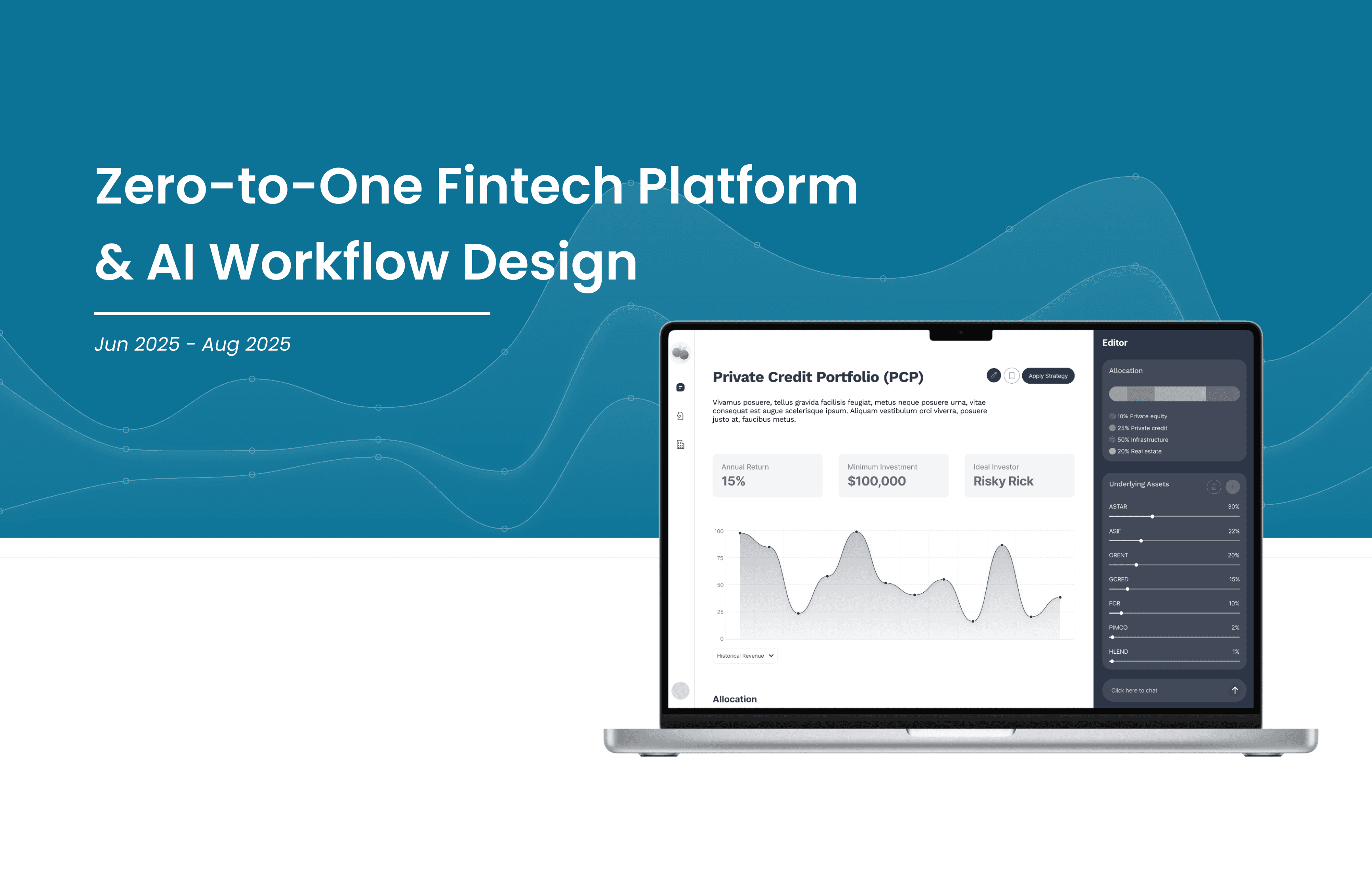

Founding Product Designer

Fintech

Jun - Aug 2025

Figma, Miro, Synthetic Users

XYZ Financial

A fintech startup aiming to transform how financial advisors invest in both traditional and alternative assets.

Current tools are outdated and create friction

As the founding product design intern, I consulted XYZ from day one — no product, no brand, no users — and took ownership of everything from product strategy and research to UX design, branding, and tone of voice.

In a short period of time, I built the foundation for their first prototype, now being used in investor pitches and development planning.

Discovery

While I was on a short timeline I needed to gain an understanding of the investment industry and current pain points.

CO-DESIGN WITH SYNTHETIC USERS

Data highlighted current challenges but wasn't forward thinking

I began with conducting a co-design with synthetic users, which used large language models to simulate interviews with financial advisors. This helped understand more about the investment industry while, uncovering key pain points across RIAs, private bankers, and asset managers:

Manual rebalancing and due diligence

Difficulties in matching portfolios to client goals and personalities

No centralized space for experimentation or education

Lack of integration between advisor tools

While helpful, I realized synthetic feedback reflected the current state, and not the future I wanted to help create.

PIVOT

Instead of improving on outdated systems, I started from scratch and asked, “What would this look like if we built it today?”

Defining the Core Product

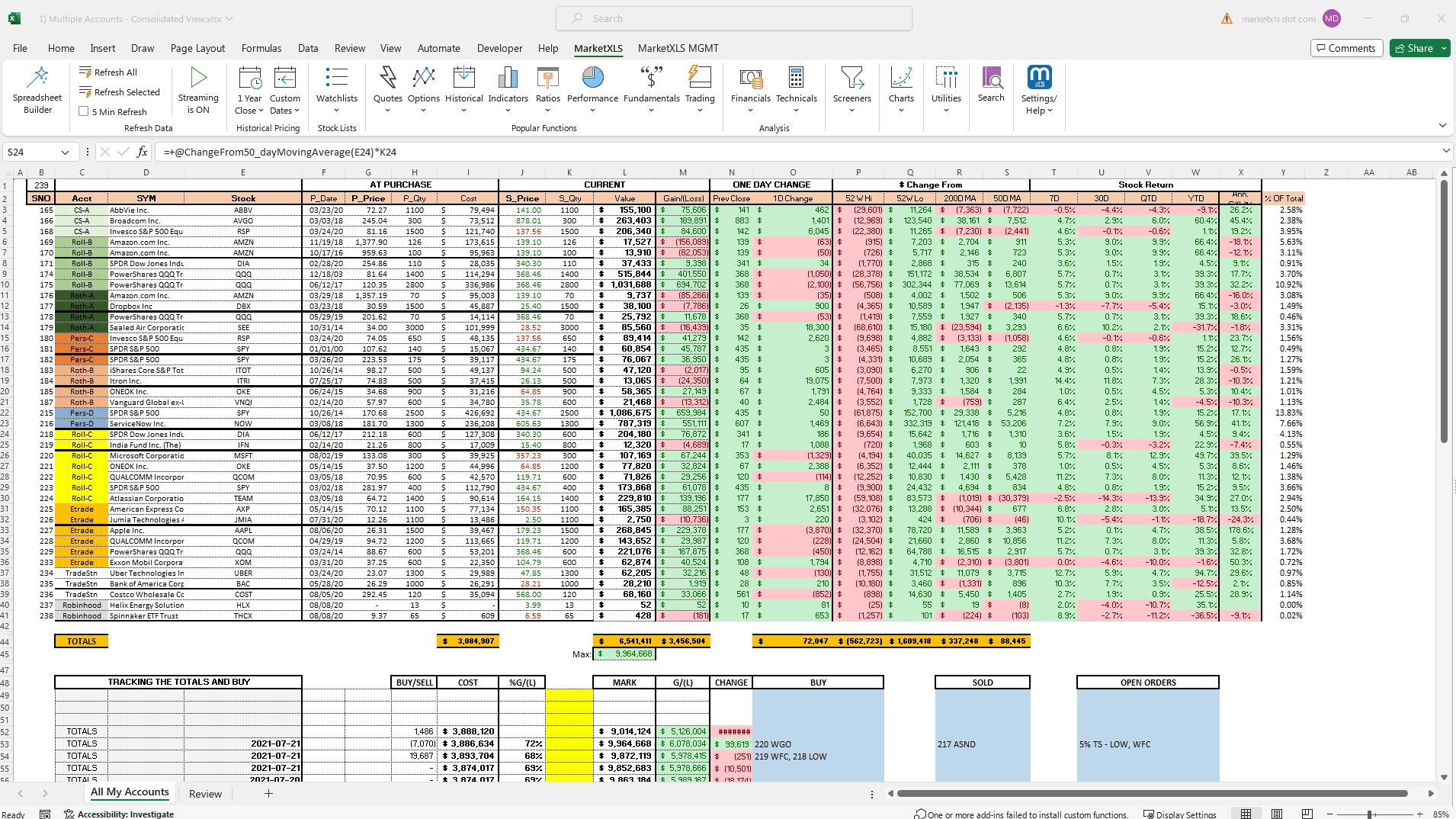

After identifying user pain points, the founders and I narrowed the product’s key services and features, then moved into ideation and iteration, progressing from initial sketches to a mid-fidelity prototype.

Rebalancing Portfolios

Manual and time-consuming processes for users.

How I addressed this:

By auto-flagging accounts, suggesting tax-efficient trades, and integrating liquidity alerts, the rebalancing process is reduced from days to just a few clicks.

Portfolio Building

Client information is scattered across platforms, and varying client goals make accurate portfolio simulations difficult

How I addressed this:

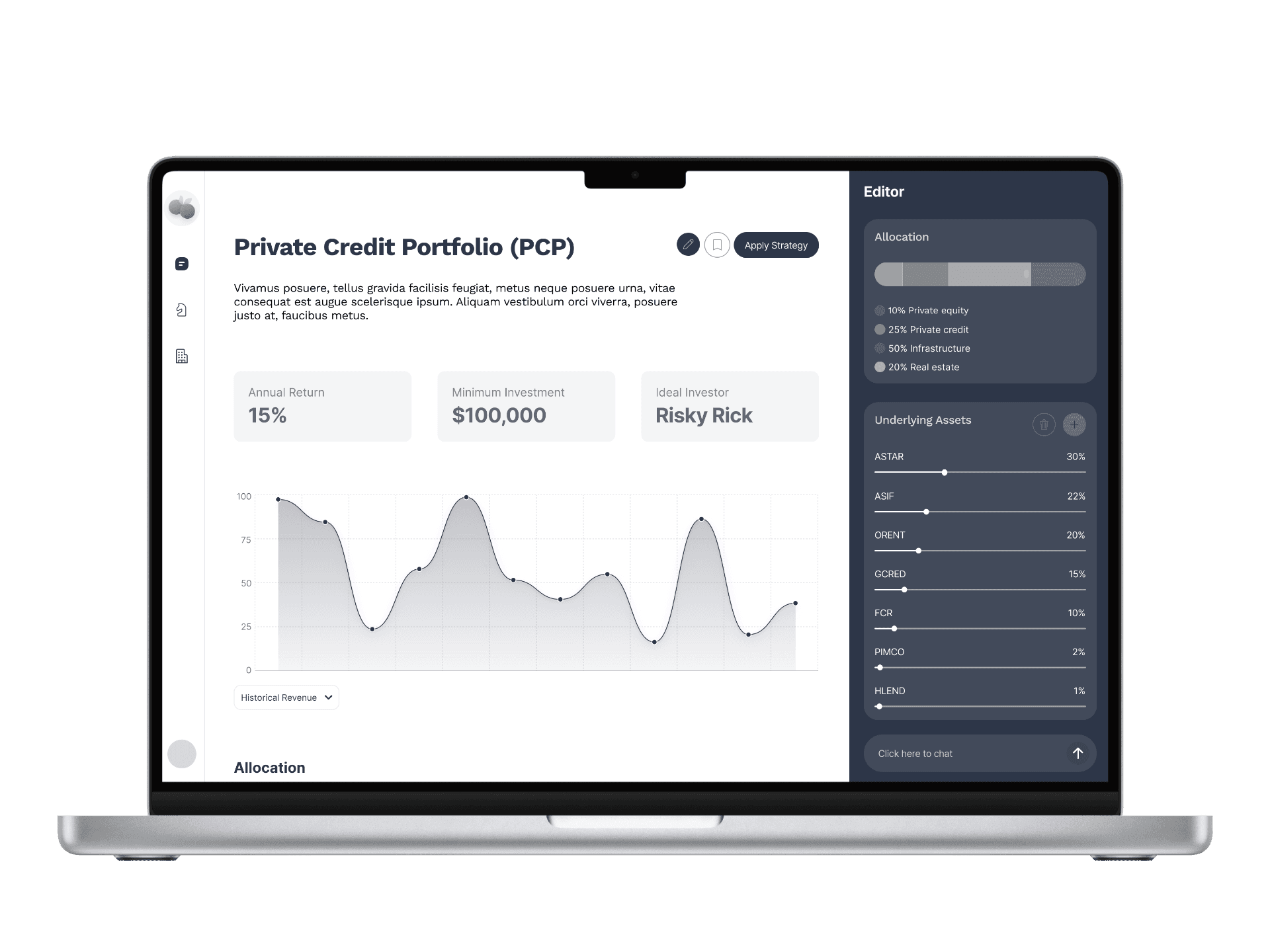

An AI-powered chat lets users build goal-based strategies by experimenting with personas like Risky Rick or Nervous Nelly or using a client profile. This interactive approach clarifies options and speeds up portfolio creation.

Exploring and Customizing Strategies

No way to compare or edit strategies in real time

How I addressed this:

Integrated interactive visual tools that simulate allocation changes and display instant feedback on liquidity, risk, and client suitability, supported by AI-driven recommendations.

SKETCHING TO MID-FI

After identifying the product's key features I moved on to ideation and iteration, progressing from initial sketches to a mid-fidelity prototype.

Due to NDA restrictions, I am unable to display further sketches, wireframes, or screens.

Branding Through UX

The company’s name (under NDA) suggested something small but punchy — a spark of flavor — and I infused that energy directly into the voice. The tone became approachable, clever, and a bit playful, making finance feel fresh.

This translated into product copy like:

“Freshly Ground Updates” for notifications

“Let’s Start Fresh!” when creating a new portfolio

Brand voice wasn’t just copy, it became part of the product experience.

PERSONALITY BASED METRICS

That same personality-driven approach extended beyond microcopy and into the product’s core strategy tools. I introduced a personality-based strategy system that used client archetypes to guide advisors. The archetypes helped them:

Match strategies to different client types

Create a shared internal language

Model client tolerance to personalize portfolios

Benchmark performance not only against markets but also against human behaviors

For example, risk dashboards displayed both industry benchmarks and archetype suitability, bridging data with empathy.

Reflection

Through this experience, I worked across product design, branding, strategy, and functionality, learning how tightly these disciplines are connected in shaping meaningful products.

Working within startup constraints pushed me to approach research more resourcefully. Without funding for traditional user interviews, I learned to test ideas early, gather feedback, and move forward without perfect information. In an environment full of unknowns, I learned the value of taking initiative, designing first, and using constant feedback to find direction rather than waiting for instructions.

Throughout the project, I balanced business goals with user needs, ensuring strategic objectives never compromised clarity, trust, or usability. Working through ambiguity taught me how to create clarity through structure, experimentation, and storytelling. Every decision, from “Freshly Ground Updates” to AI-driven rebalancing, reflected how branding, strategy, and UX came together into a single product experience.

Next time, I would deepen my financial industry expertise and integrate real user feedback earlier and more consistently throughout the process.